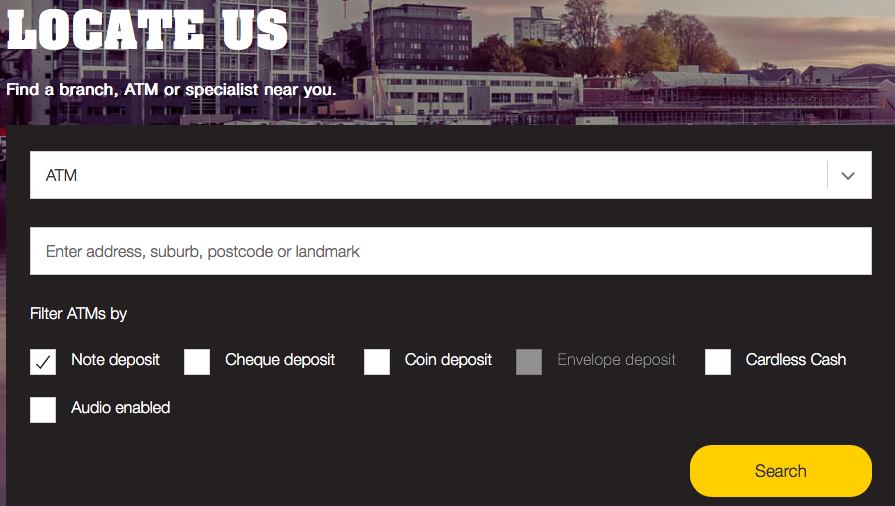

The Commonwealth Bank submitted two records to AUSTRAC, then exactly four weeks later, the remaining 53,503 flooded in. 'It must have been absolute pandemonium,' Verrender said. Commonwealth Bank - Instant Deposit ATM. Archive View Return to standard view. Last updated – posted 2016-Sep-18, 8:31 pm AEST posted 2016-Sep-18, 8:31 pm AEST. 2 Cardless Deposits with account details can be made up to $1000 per transaction for cash amounts and no more than twice per day per mobile phone number. A standard $10,000 cash deposit (notes and coins) limit applied per account per day. Cardless cash is available from any CommBank ATM. The Commonwealth Bank submitted two records to AUSTRAC, then exactly four weeks later, the remaining 53,503 flooded in. 'It must have been absolute pandemonium,' Verrender said.

The cardless cash of Commonwealth Bank (CBA) is a convenient feature that allows you to withdraw cash at CBA ATMs without a physical card. With this feature, you only need to carry your smartphone for cash withdrawal. This post explains what the CommBank’s cardless cash means and how you can use it.

Cash Withdrawl Without Card

The main benefit of Commonwealth Bank Cardless Cash is that you don’t need a card to cash out from a CommBank ATM. All you need is your smartphone with the CommBank app installed. What’s surprising is that you can use this feature to let someone else collect the money for you. Thanks to easy and around-the-clock accessibility to ATMs, you can use the cardless cash 24/7 and withdraw up to $500 per day.

Cardless Cash Commbank without App

Before going in detail, let me clarify the fact that you cannot use Commbank Cardless Cash with the app. You must use the app to select various options.

Requirements

If you liked the feature and got interested in having one, you first need to have a bank account with Commonwealth Bank. A CommBank Everyday account specifically. The bank website points out that opening an account will be completed under 5 minutes. After that, you need to download the latest version of the CommBank app on App Store or Google Play.

How to Use Cardless Cash

Get a taste of how you are going to use it. You might not like it if the steps are too complicated. But, it looks pretty straightforward to me.

- After you go through all the requirements, log onto the CommBank app and choose ‘Get Cardless Cash’ from the menu on the left.

- You can choose whether you or someone else will collect the cash.

- Choose your amount. Then, the app will create an 8-digit Cash Code.

- The CommBank app also sends an SMS with a Cash PIN.

- You need to use both numbers within 30 minutes to withdraw cash from the CommBank ATM.

- If you or someone else don’t get there in time, your money will be returned to your account.

You will have to register your phone number using the CommBank app to receive the Cash PIN. If you select someone else for collection, you will be required to put the person’s phone number, and the PIN will go to that number. Once the Cash Code has been created, it will be valid for 30 minutes.

I hope that the process is not too complicated. Wisely, it has the 30-minute window, and when it has passed, the money goes back to your account, which I think is a good security measure. If you failed to arrive at the ATM within 30 minutes, you can simply retry the steps.

Use Cardless Cash for Someone Else

Imagine you are trying to let someone else withdraw cash from your account without cardless cash. You will have to travel together or give your credit or debit card with the PIN number to that person. Giving away your card with the PIN is not secure at all. Plus, after that, if you want to change the PIN number, it is quite complicated. In that regard, I think using cardless cash for someone else to withdraw your money is much more secure and easier. The Cash Code and Cash PIN are one-off, and they will be changed ever time you go through the steps.

What if you make a mistake

People can make a mistake. I know that you might be worried about making a mistake while using the Commbank Cardless Cash since it involves money. After you generate the PIN code, if you want to cancel it, you can still do that. The cancellation is available at any time prior to the cash being withdrawn at the ATM or the cash code expiry. Please note that if you let someone else collect the money and cancel it, you will want to notify the person of the cancellation.

How many ATMs CommBank has?

The Commonwealth Bank Cardless Cash system will only be useful if you can find a CommBank ATM. There is no point to use the feature if the bank has not many ATMs. This CommBank webpage explains that they have over 3,000 ATMs across Australia. You might now wonder which bank has the largest ATM network. According to the Finder article, it seems that Commonwealth Bank has the largest.

As you can see from the list, the Commonwealth Bank and Bankwest network has the largest network with more than 4,000 ATMs in Australia. So you don’t have to worry about having difficulty in finding one.

How much do people have an interest?

Is cardless cash of CommBank popular that people keep showing an interest? Or, did people find that it is not very helpful and they just stop using it? One good way to measure people’s interest in a product or service is using Google Trend. Google is the largest Internet search engine without a doubt. They record all search keywords that are typed into that search input box. What Google Trend does is sharing the frequency of each search keyword searched over a specific period of time.

It is a very powerful tool to research a trend, and I used it to gauge people’s interest in the cardless cash. Please have a look at the graph below.

I research this keyword, “commonwealth bank cardless cash” using Google Trends to see how people’s interest has been changed over the past 5 years. As you can see, there was a spike near August 2017. Other than that, the trends for the keyword has been consistent and stable. If this trend continues, people will keep searching about the CommBank’s cardless cash. Then, what about the trend of “cardless cash” overall?

For the same period, the search volume of cardless cash has been consistent without a major drop.

Cardless Cash in General

Cardless cash is not a unique feature you can find in CommBank only. The big 4 banks in Australia provides a similar feature to its customers. ANZ does not have cardless cash but offers a digital wallet. Westpac also has cardless cash. Let’s find out what common features they have for cardless cash. I referred to this cardless cash post on Finder for my research.

Common General Benefits

- No matter what bank you choose for cardless cash, the main purpose is the same – it allows convenient travel without a card or a wallet.

- If you unintentionally left your wallet at home or lost it somewhere, you can continue to access your cash.

- Cardless cash makes it easier to give trusted family members a controlled and limited access to your account when they need it. You don’t have to pay for extra debit cards or worrying about the limit they can withdraw. You can control their spending by using the app.

- You might like the fact that you don’t have to pay any extra costs for using cardless cash. The bank’s app will be free, and as long as withdrawal from your bank network is free, it will be free.

- As I mentioned, thanks to the security measures using the codes, you can access your cash with increased security.

Common Drawbacks

Although a cardless cash system brings great benefits to you, it is not for everyone and every bank.

- Not all banks have cardless cash.

- Only ATMs in your bank’s network can be used.

Banks with Cardless Cash

According to the Finder reference, as of August 2019, only 5 banks are offering cardless cash. I learned that some people tried to find Bendigo bank cardless cash. Unfortunately, Bendigo bank does not offer cardless cash at the moment.

While CBA does not have a weekly limit, the rest four banks have a weekly limit of $1,000 and the code expiry is 3 hours.

Commbank Deposit Atm

Conclusion

Commonwealth Bank Cardless Cash is a convenient way of withdrawing cash without your card or wallet. As we found out from the how-to steps, it is simple to use it and secure as you will use two different codes and 30-minute window. Plus, it is an interesting concept that you can easily let someone else withdraw your cash. Best of all, it doesn’t cost you. If you are using one of the banks offering cardless cash, go creating one.

Commbank Deposit Atm Canberra

Useful Links

Commbank Deposit Atm Penrith

I wrote about cardless cash in other posts as well. Go check these articles to find out more.